|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

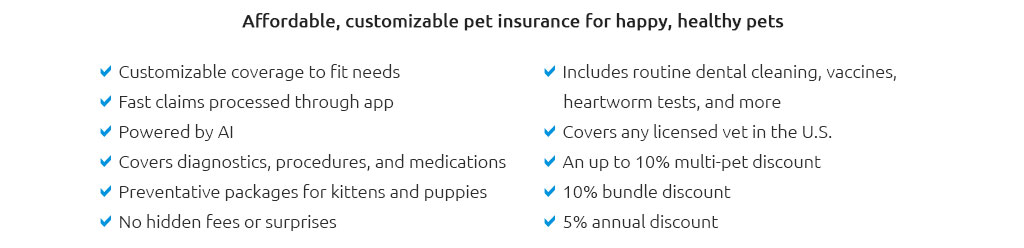

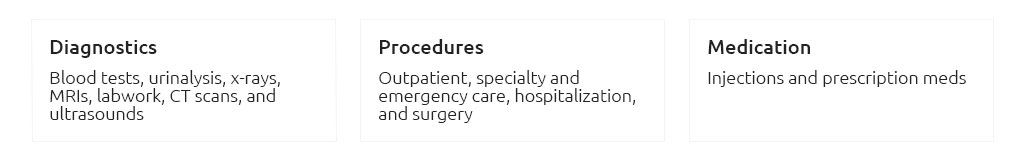

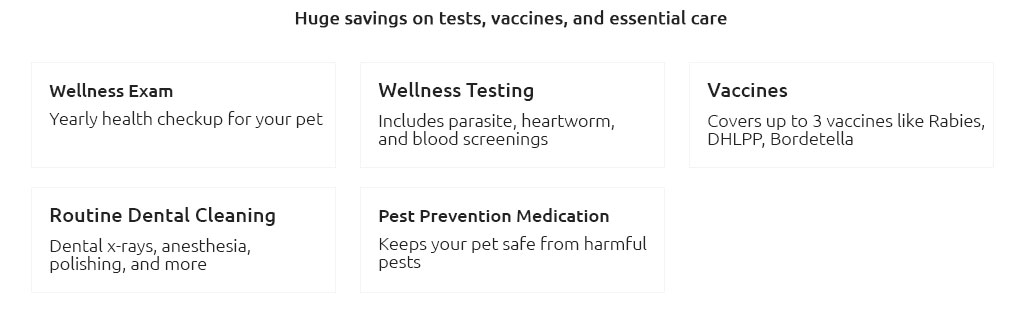

The Ultimate Guide to the Cheapest Pet Insurance for CatsFor those of us who share our lives with feline friends, ensuring their well-being is a top priority. However, veterinary costs can quickly add up, making pet insurance an appealing option for many cat owners. The challenge lies in finding the most affordable pet insurance that still offers adequate coverage. This guide will delve into the intricacies of selecting the cheapest pet insurance for your cat, offering insights and tips that are beneficial for beginners navigating this complex landscape. Firstly, it’s crucial to understand what pet insurance typically covers. Most policies offer protection against unexpected illnesses and accidents. However, coverage can vary significantly between providers. Some plans may include wellness care, dental treatments, or even alternative therapies, though these often come at a higher premium. It’s essential to read the fine print and ascertain what each policy specifically covers and excludes. To embark on this journey, start by assessing your cat’s health needs. Younger cats with no pre-existing conditions might benefit from a basic plan, while older cats or those with known health issues might require more comprehensive coverage. It’s a common misconception that cheaper plans equate to inferior service. Many budget-friendly options provide excellent value, especially if your cat is relatively healthy.

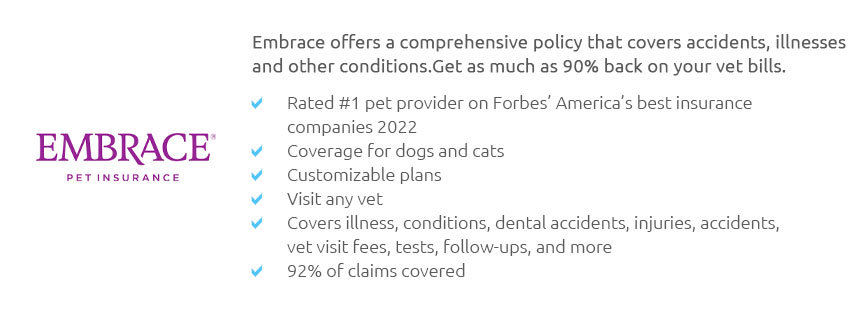

Subtly, it’s worth mentioning that while finding the cheapest insurance is important, the goal is to find a policy that offers the best balance between cost and coverage. Some cat owners have found that spending a little more upfront on premiums saves them significantly in the long run, especially in cases of unexpected illnesses or accidents. In conclusion, the cheapest pet insurance for cats is not merely about the lowest monthly payment. It’s about value and peace of mind. By carefully evaluating your cat’s needs, researching various providers, and considering factors such as deductibles and discounts, you can find a policy that protects your feline companion without breaking the bank. Remember, the right insurance plan is an investment in your cat’s health and your financial security, allowing you to enjoy the companionship of your furry friend worry-free. https://www.geico.com/pet-insurance/

Pet health insurance provides coverage for unforeseen medical expenses such as non-pre-existing illnesses and injuries. This can help make health care for your ... https://www.petinsurance.com/cat-insurance/

Nationwide cat insurance offers customizable insurance plans that cover accidents, illnesses, and wellness starting as low as $7 a month*. https://www.usnews.com/insurance/pet-insurance

We found a sample rate of $30.19 per month to cover a dog with Pets Best. Its sample monthly rate for cat insurance is $17.48. Customizations: The accident-and- ...

|